📊Tokenomics / ICO

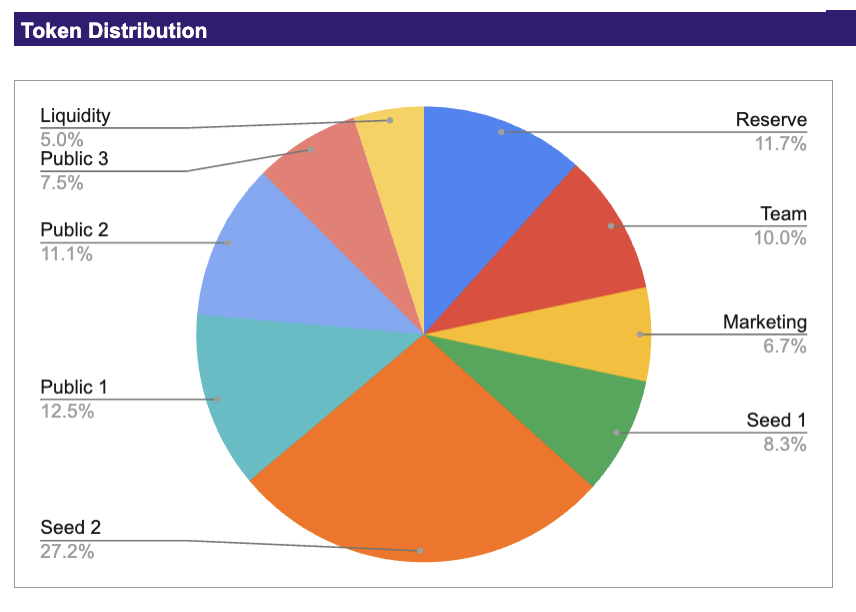

Distribution

Our initial distribution corresponds with the level of decentralization we're aiming for.

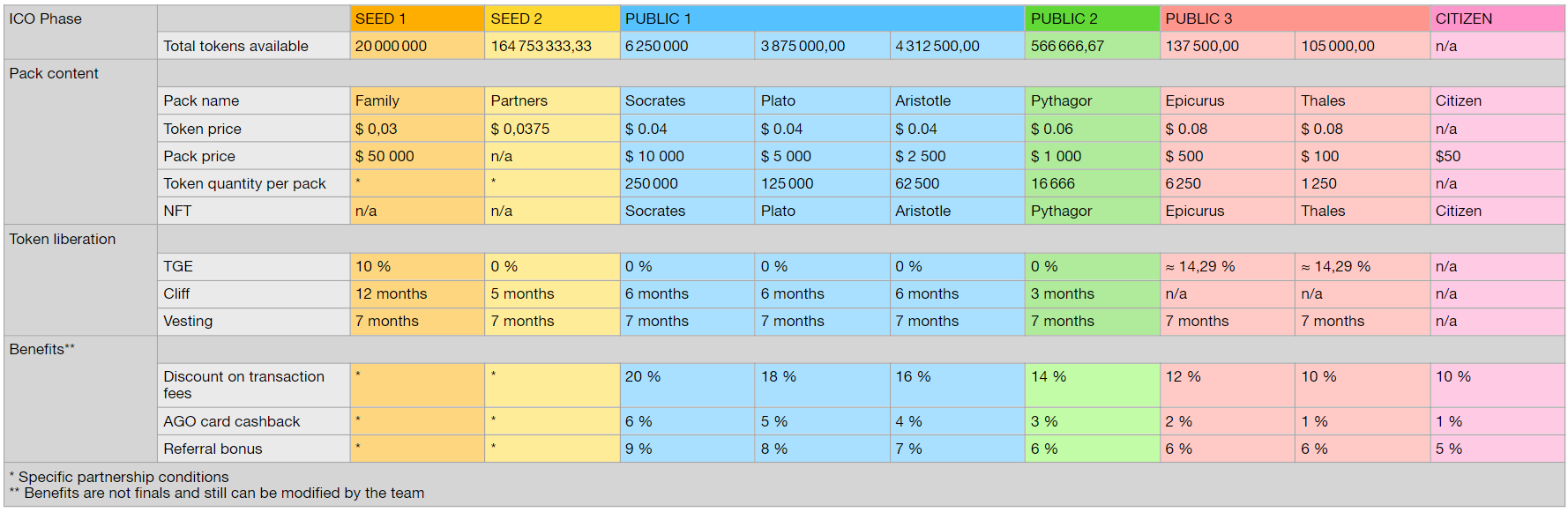

Public and private phase

-> 300 000 000 AGO

Vesting refers to the gradual unlocking of tokens granted to individuals over a specified period, typically to incentivize long-term commitment and prevent immediate selling.

A cliff refers to the initial period during which vested tokens remain inaccessible before any portion becomes available for access or sale.

Reserve

-> 35 000 000 AGO

Tokens allocated to reserves will be used for the platform’s future development. Tokens will be released over 24 months.

Team and partners

-> 30 000 000 AGO

AGO allocated to the team and partners will be released over 60 months.

Marketing

-> 20 000 000 AGO

Tokens allocated to marketing will be used for platform communication and growth. 50% of AGO will be released following the Token Generation Event (TGE) and the remaining 50% will be released 12 months later.

Liquidity

-> 15 000 000 AGO

These AGO are allocated to liquidity necessary to allow swaps through automated market maker Dapps (e.g. Pancakeswap).

Price sustainability

Much like commodities (such as gold and diamonds), the cryptocurrency economy is based on the sound and universal principle of supply and demand. This balance has been carefully considered to limit supply and, on the other hand, to ensure growth in demand.

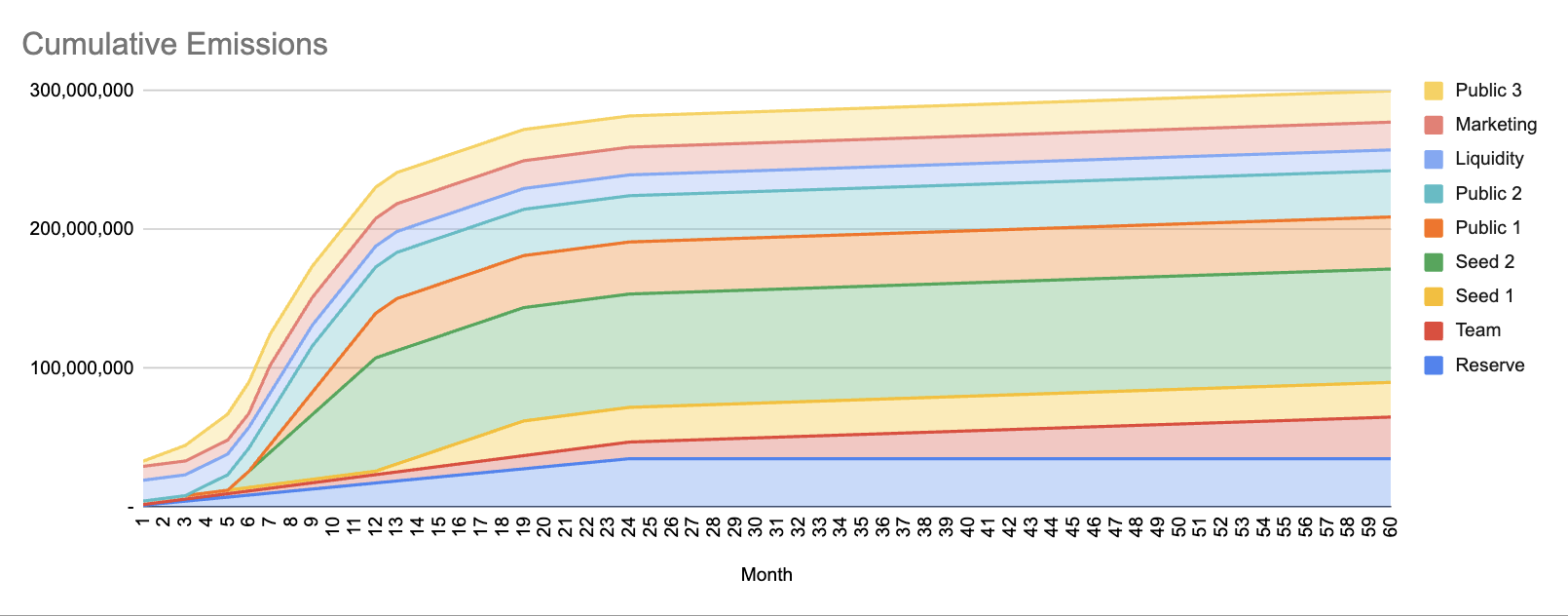

Management of the supply

Limited supply: The number of AGO tokens has been set at 300 000 000 units. No additional tokens will be issued.

Limited distribution: The objective is to limit the release of large quantities of AGO on the market. This would suddenly increase the supply, which could lower the price.

Management of the demand

Development of use cases to create an incentive to buy and keep tokens (staking, cashback, launchpad, etc.).

To ensure token liquidity, it will be listed on one or more trading platforms.

Development of the network through our partners with fair compensation of the costs incurred by Ago.

Use the marketing budget wisely with the help of the community to ensure the growth in the number of users.

To ensure token price sustainability, two mechanisms have been put in place - lock-up and burning.

Lockup

This refers to a minimum period during which the investor cannot withdraw the token.

Burning

Tokens that are not sold during the public sales will be burned (i.e. destroyed), thus limiting the available number of tokens on the market. Similarly, all other tokens (teams, reserves and marketing) will be burned in proportion.